According to ATTOM Data Solutions, 6.2% of home sales in the U.S. in 2019 came from flipped homes. This data is enough to tell you that flipping houses have grown widely to become a lucrative business opportunity.

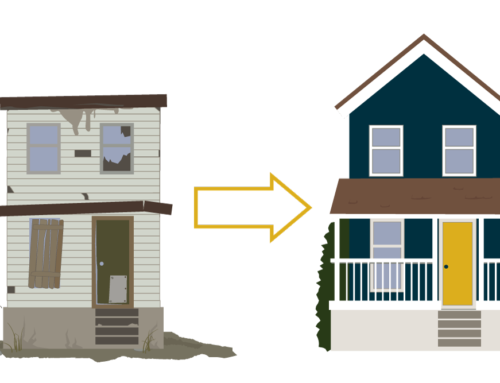

Flipping houses is a real estate investment that involves buying a house, improving its curb appeal, and reselling it at a higher value. Well, like any other investment, house flipping requires money. But what if you don’t have that capital?

This is where fix and flip loan comes in.

That takes us to the big question. What are fix and flip loans, and how do they work in this kind of real estate investment? Let’s take a look at that below.

Understanding Fix and Flip Loans

Do you need money to invest in house flipping? Well, house flipping is an investment like any other, and that means funding is a necessity.

Remember the word fix? Buying and fixing property requires money. You must do some renovations or reconstruction work to improve the curb appeal of that specific house before selling it at a higher value.

But you don’t need a lot of money to start flipping houses. This means you don’t need to take a huge amount of loans to get you started.

Fix and flip loans are some type of short term loans given to real estate investors to do the house flipping business. Many trusted lenders are willing to give out this kind of hard money loan without even going through your credit history. So, lack of finances or bad credit history should not deter you from investing in a fix and flip business.

The Costs Involved with House Flipping

Before you can decide to take a fix and flip loan, you must understand all the costs associated with house flipping. This information is essential because you must know the amount of capital you need.

Besides the buying and renovation costs, flipping houses involve other additional costs that every real estate investor must factor in.

One important thing you should never ignore is property taxes. These taxes vary with estates and depend on several factors. Does the house need seasonal maintenance? Is there a HOA in the neighborhood where the house is located?

Think of all the money you’ll need to cover every cost around your property. When you carry out enough research and come up with a fixed figure, you will understand how much money you’ll need to borrow.

It’s also important to understand that fix and flip loans only apply to residential houses. Any commercial structures such as a school will not qualify for this loan.

That takes us to the question the next question.

What Can Fix and Flip Funding Do?

House flipping starts with purchasing a house at a discounted price. The intention is not to keep the house but put it back in the market at a higher price.

House Renovations

Most of the time, the houses purchased with flipping intentions aren’t in good condition. The seller will need to do some touchups to improve the curb appeal hence increase its value.

Most of the renovations include improving the floors such as tiling, installing new kitchen cabinets, painting, furnishing, etc. This work requires finances. If you don’t have enough capital, fix and flip loans can come to your aid.

Full Constructions

Flip and fix loans don’t only work on existing houses as the investor can still buy land with a small or old house, demolish it, and put up a new structure. The loan type also works well as a financing option for home builders as long as they aim to resell the house after the work is completed.

Types of Fix and Flip Loans

There are different types of lending options for your real estate that you can choose from depending on your financial needs. Fix and flip loans vary with requirements, fees, and interest rates.

Two of the most common types of fix and flip loans include;

Hard Money Loan

Hard money loans are short term asset-based loans available for real estate properties. These loans don’t take the credit history of the borrower into account when processing. They focus on the initial property value or after repair value (ARV).

These loans have lower demands in terms of requirements but attract high-interest rates. Hard loans are one of the quickest ways to get funding for your real estate investment.

Bridge Loan

A bridge loan is another financing option that real estate investors can get to purchase, repair, and resell a property. They are also short term loans that come in aid of borrowers with urgent needs or financial obligations.

Bridge loans take the shortest time, up to a year, and attract high-interest rates. The lenders will use the property as collateral in this type of loan.

Why Take House Flipping Loans

There are many reasons why a real estate investor should choose fix and flip loans and not any other type of funding. Here are some advantages that this type of lending provides.

Short-Term Loans

Fix and flip loan is a short term loan that takes a duration of about 12 to 24 months, making them easily accessible. Should you pay the loan before the period; the lenders will not slap you with prepayment penalties as the loans don’t attract such.

Security

With this kind of financing, the house you intend to fix and flip serves as collateral, meaning the loan is secured. In case the borrower defaults, the lender can take the house ownership.

Fast Approval

Flip and fix loans have minimal requirements, and the processing time takes the shortest time possible. The loan approval only takes days hence perfect for solving urgent financial needs.

No Finances for Your Real Estate Business? Get Hard Money Loans

Now, if you want to start a house flipping business and your finances are not promising, you don’t have to worry because you have fix and flip loan lenders by your side. Lack of funding should not be why you haven’t started your dream business of flipping houses.

You don’t know where to start? Don’t worry because Shepherd’s Finance is here to guide you all the way until you get your funding. Contact us today and let us help you get started buying, renovating, and reselling those houses.

Stay In Touch