Understanding the Current Economic Environment & How it Impacts Homebuilders

Navigating the current economic environment as a residential homebuilder can be exhausting. Between housing markets, building materials, subcontractors, inflation, tariffs, and mortgage rates, it’s a lot to manage. Shepherd’s Finance has experts who have been in the industry long enough to have witnessed the best and worst ebbs and flows of the market and to have navigated trying times smoothly. One expert at Shepherds Finance is CEO Dan Wallach. Dan has over 35 years of experience in finance and the homebuilding industry and has provided insights into the current environment, what you can expect next year, and how to use these changes to your advantage.

Introduction

The current economic landscape in the United States sometimes suggests that conditions aren’t favorable for homebuilders. When there’s a storm – hurricane, pandemic, or government shutdown – it’s easy to develop a grim perception based on where you’re standing. However, stepping back allows you to see the whole picture, which often tells a different story.

Dan Wallach, the CEO of Shepherd’s Finance, has over 35 years of experience in finance and lending. Having weathered many storms, including the housing crisis of ’08, he can see through the wreckage and debris of these storms and help guide builders like you to success. In this blog, Dan offers insight and analysis into the current impacts on home builders, how to interpret the information, and how to use it to your advantage.

Homebuilder Economic Impacts – An Analysis

Starting with a positive note, random length lumber futures, or the standardized pricing for softwood lumber, are down 15%. This means that builders can buy their primary material more cheaply.

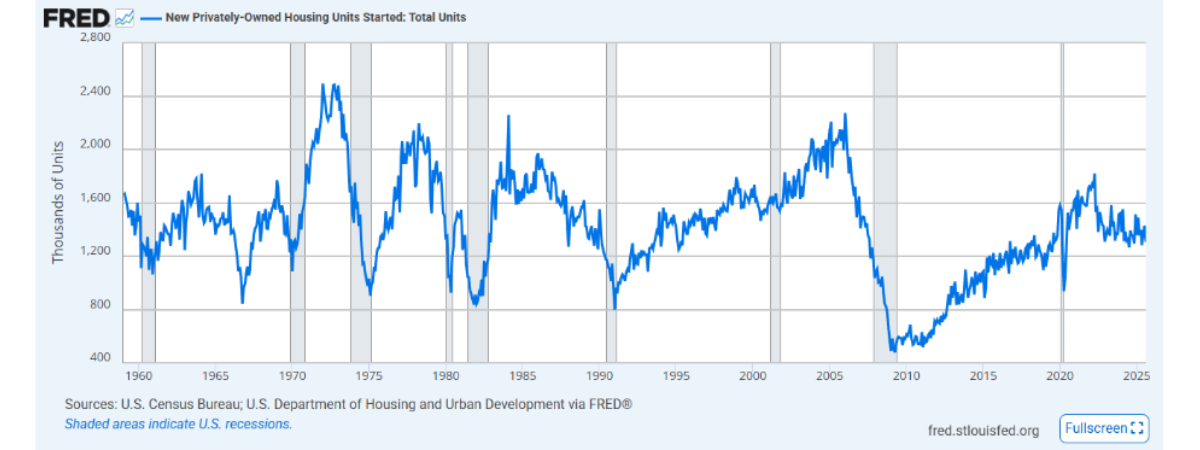

Next, we take a look at housing starts, unemployment, and builder confidence. Housing starts, which measure the beginning of new residential construction across the United States, are about 20% below their levels from the last four years. Year-over-year, the data shows housing starts are down 6%, and month-over-month, they are down 8.5%. The data show that these numbers are not increasing. Meanwhile, unemployment changes remain stable. This indicates that although builder confidence is lower, quit rates are also lower.

How do mortgage rates and the Federal Reserve fare in all of this?

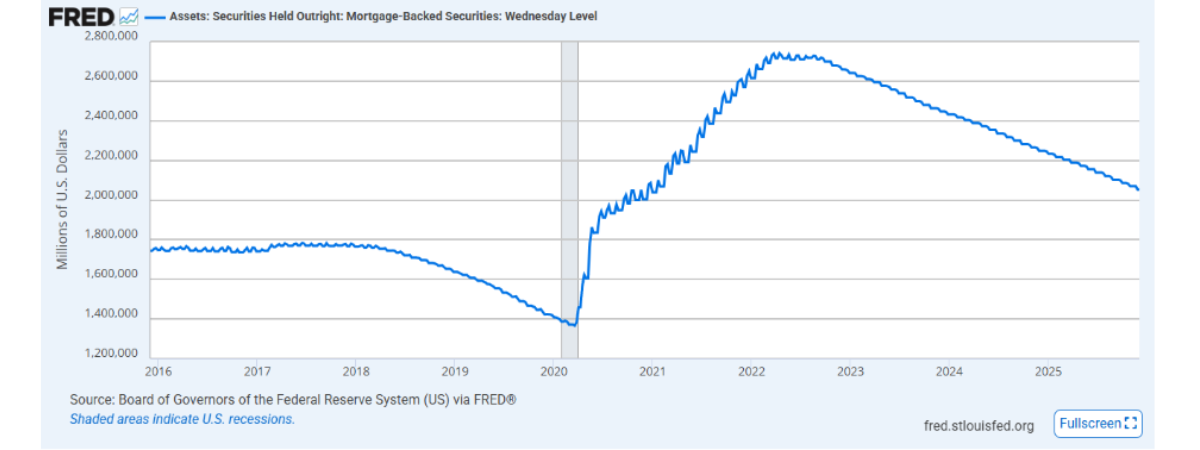

The Federal Reserve continues to dump mortgages, which causes mortgage rates to rise. So far this year, they have sold another $637 billion worth, leaving less to offload since all the mortgages purchased during the pandemic are almost sold through.

Currently, mortgage rates have fallen from 6.35% to 6.03% over the past month. Dan projects that by next summer, rates will improve even more, potentially approaching 5.5%. This means that home builders can potentially expect more housing starts as we move into 2026, as demand for home purchasing will begin to increase in the summer of 2026.

Getting Costs Down as a Home Builder

Now, a big question still remains: how do tariffs and inflation influence all of this now and next year? Dan Wallach reports that inflation has increased slightly, from 2.9% to 3.0% in the past month. Inflation peaked during COVID and has been on a downward trend since then, showing significant improvement this year. With rates decreasing and housing starts also declining, the labor market is softening.

A softening labor market means that suppliers to builders, laborers, concrete masons, etc., have less work, which opens the door to negotiating lower prices with these subcontractors. The same applies to the supply and demand for products needed to build homes. Housing starts are low, indicating less demand for these products. As mentioned earlier in this blog, we are seeing lumber futures down 15%.

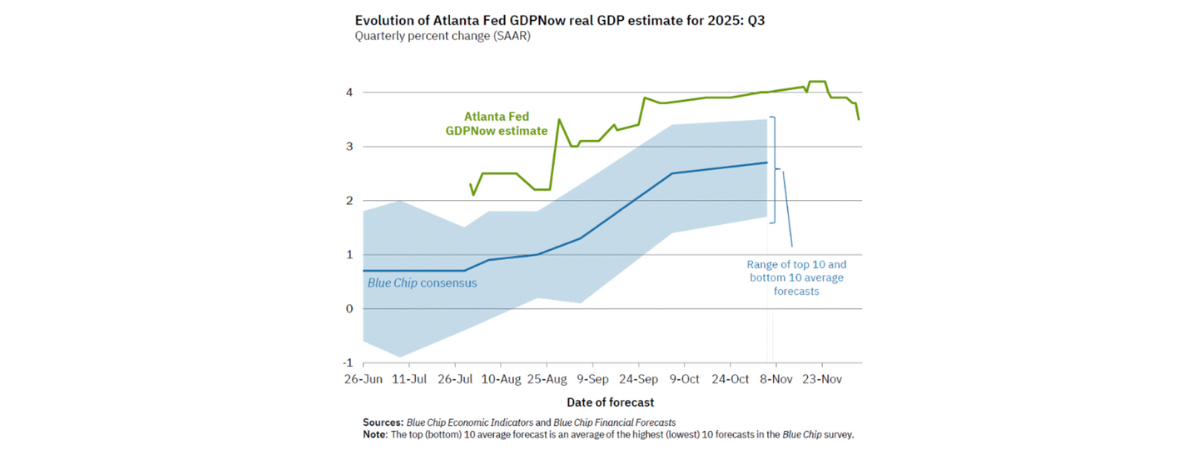

Another thing to note is that Real GDP (gross domestic product), or the total value of all goods and services produced in the economy (adjusted for inflation), is increasing in the United States, with the fourth quarter of 2025 projected to end between 3.5% and 4.5%.

What does all of this mean? First, while tariffs and inflation may influence some pricing, the overall picture is that residential homebuilder pricing remains largely unaffected. Second, combined with lower housing starts and decreased demand for building materials and labor, you have the perfect situation for negotiating better prices on your projects. Lastly, the Real GDP projections indicate that U.S. production is continuing to grow, with housing starts expected to increase, mortgage rates to decrease, and demand for new housing to rise.

Housing Market Analysis

The current housing market remains steady primarily throughout the year. The starter and upper-tier housing markets are performing well. However, the mid-market shows the lowest housing starts, as current mortgage rates reduce demand.

Mid-market housing prices are declining faster than in other markets. Mid-market homes are selling for a lower price per square foot than the same price as smaller starter homes. However, once construction begins in January and February 2026 and homes are sold in the summer, demand and prices for mid-market housing should start to recover and return to normal.

A New Approach: 50 Year Mortgages

Mortgage rates and terms are frequently top of mind for home builders. The US government has proposed a new option for 50-year mortgages. The purpose of 50-year mortgages is to help homebuyers achieve lower monthly payments. For most buyers considering a 50-year mortgage, the average payment could be about 10% lower. Additionally, it might enable a homebuyer to afford a home that is 10 to 15% more expensive than what they could qualify for with a traditional 30-year mortgage.

The implication for consumers is a longer mortgage, with more interest paid over time. This means consumers would build equity more slowly, but it could potentially give people who previously couldn’t qualify for a mortgage the chance to buy a home.

This proposal offers some positives for home builders. It means more potential buyers and the possibility of building more homes to meet the growing demand if 50-year mortgages become available.

The Shepherd’s Finance Way of Lending

Shepherd’s Finance is a construction spec lender that approaches things differently. Our goal for our builders is to see them grow, thrive, and reach their business goals. We achieve this by offering a lending program that stands out from the rest. Our program is unique because it recognizes and addresses the challenges and needs of the home-building process. We partner with our builders to ensure they meet deadlines, have sufficient funding, and successfully navigate the constantly changing home building environment.

With up to 72.5% LTV, no junk fees, and dedicated staff every step of the way, our lending guarantees you get what you need. If your project is standard, we can fund it. For unique projects that require special considerations, we do that too. At Shepherd’s Finance, we help builders grow by understanding that excellence doesn’t fit into a mold or the requirements traditional lenders set. We’re here to work with you and provide the funding that meets your project needs.

When you partner with us, you gain access to our industry experts, who collectively bring over 80 years of experience. Reach out today to start your 2026 projects now.

We invite you to consider how Shepherd’s Finance can help empower your home construction projects. With our lending solutions and business growth services, we’re here to support you at every step. Let’s build something remarkable together!

Find your regional sales manager today for more information or to get started. Happy building!

Stay In Touch